I’m interested in Home Ownership…

but, I don’t know if I can afford it.

but, I don’t even know where to start.

and I’m ready to start my journey!

Can I afford a home?

Homeownership is an American dream, but how do you know if you can afford a home?

What to expect

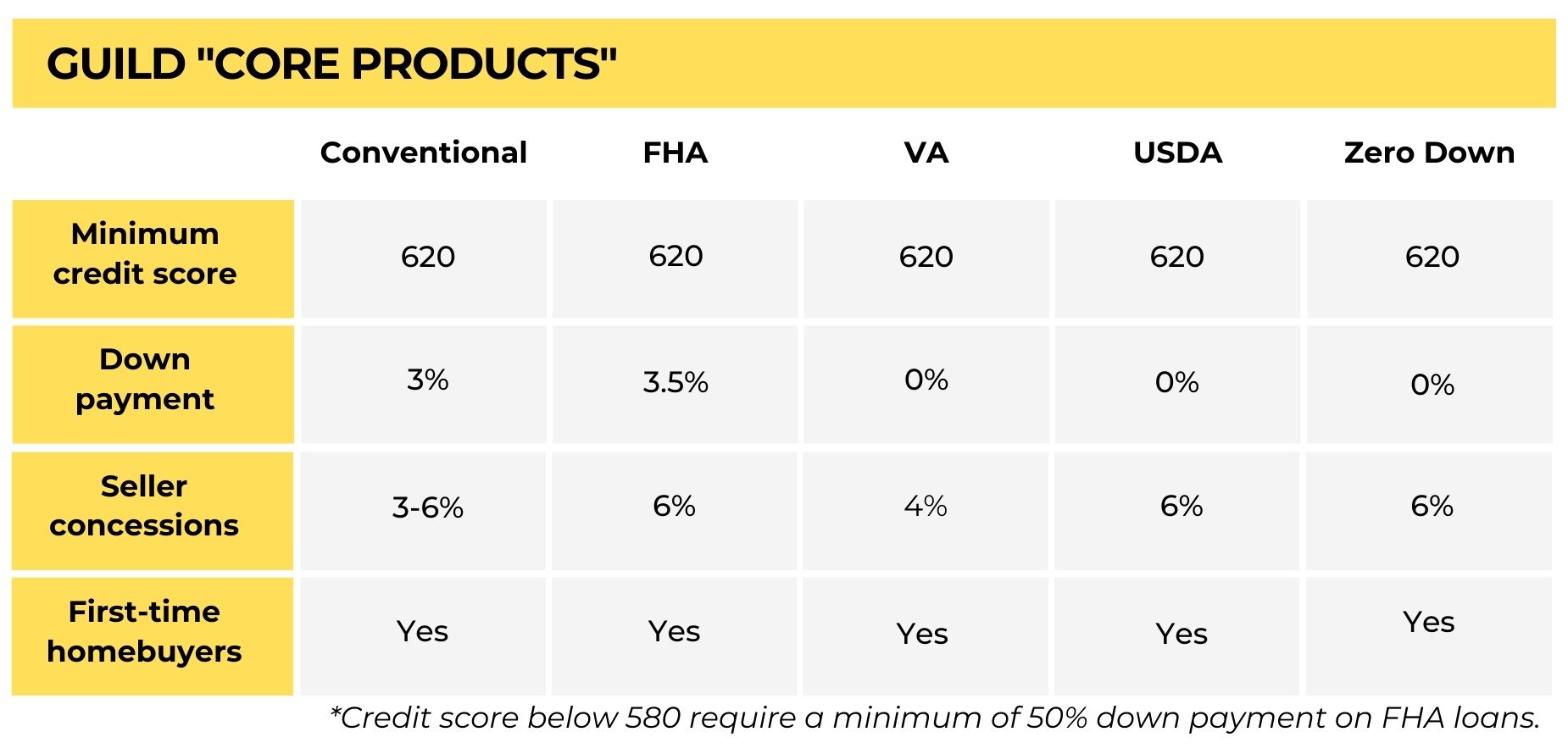

If you are a first-time home buyer, you may qualify for first-time home buyer programs depending on your financial situation.

It’s a good rule of thumb to save a minimum of 10% when purchasing a home. This should cover your down payment + closing costs if you qualified for an FHA or Low Down Payment Conventional loan program.

It’s also important to have extra reserves set aside for expenses once you close on your home.

Examples of expenses:

Moving expenses

Unexpected repairs

Furniture & Utilities

Home improvements

Our expert sales agents can help walk you through this journey and connect you with a local lender for guidance and support.

Agent Support

Lender Support

Credit Support

First Time Home Buyer?

We would love to help you on your journey if this is your very first time purchasing a home!

We love helping our tenants go from renting to homeownership. This is a huge step toward building wealth through real estate. We have designed an entire program specifically for you!

Connect with us today to learn how to get started!

Steps to buying your first home

When you work with us, we’ll walk you through every step!

01. Get pre-approved

- Check your credit score

- Reach out to your lender

- Prepare your financial documents

02. Save for a down-payment and closing costs

- Map out your budget

- Consider other home-related expenses too!

03. Connect with a dedicated Sales Agent

Call 903.462.0282

04. House hunting!

- Find a neighborhood you like that fits in your budget

- Create a list of needs, must-haves and wants

05. Negotiating the offer

- Negotiate with respect

- Negotiate other costs/terms

06. Escrow process

- Get the house inspected by a licensed Home Inspector

- Prepare for any additional documents needed by the lender

07. Closing & After-closing

- Perform a final walk-through of the home

- Bring closing documents

- Turn your house into your new home 🙂

Connect With An Agent

903.462.0282

Contact

Hours

Mon – Fri: 8 am – 4 pm

Sat: By appointment only

Sun: Closed